havugroup.online

Community

How To Buy A House Based On Income

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

Understand how much house you can afford. This mortgage affordability calculator provides an idea of your target purchase price, and it's based on some. 28% is the maximum total of your housing expenses. This is known as the front-end debt-to-income ratio, which is your mortgage, property taxes, and homeowners'. You can buy a home with a single income, as many borrowers do. Single-income home buyers must meet the same home loan criteria and complete the same application. Mortgage lenders may run your financial information through a few different calculations when determining how much house you can afford based on income. You can. Determine your mortgage affordability range and see how much you can borrow based on factors including income, debt, monthly expenses, lifestyle, savings, your. Recurring debt payments: Lenders use this information to calculate a debt-to-income ratio, or DTI. A good DTI, including your prospective housing costs, is. No more than 30% to 32% of your gross annual income should go to mortgage expenses, such as principal, interest, property taxes, heating costs and condo fees. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate. Understand how much house you can afford. This mortgage affordability calculator provides an idea of your target purchase price, and it's based on some. 28% is the maximum total of your housing expenses. This is known as the front-end debt-to-income ratio, which is your mortgage, property taxes, and homeowners'. You can buy a home with a single income, as many borrowers do. Single-income home buyers must meet the same home loan criteria and complete the same application. Mortgage lenders may run your financial information through a few different calculations when determining how much house you can afford based on income. You can. Determine your mortgage affordability range and see how much you can borrow based on factors including income, debt, monthly expenses, lifestyle, savings, your. Recurring debt payments: Lenders use this information to calculate a debt-to-income ratio, or DTI. A good DTI, including your prospective housing costs, is. No more than 30% to 32% of your gross annual income should go to mortgage expenses, such as principal, interest, property taxes, heating costs and condo fees. As a general rule of thumb, lenders limit a mortgage payment plus your other debts to a certain percentage of your monthly income, which can be approximately. Use our free mortgage affordability calculator to estimate how much house you can afford based on your monthly income, expenses and specified mortgage rate.

Recurring debt payments: Lenders use this information to calculate a debt-to-income ratio, or DTI. A good DTI, including your prospective housing costs, is. Most lenders recommend that your DTI not exceed 43% of your gross income.2 To calculate your maximum monthly debt based on this ratio, multiply your gross. What mortgage can I afford? The most you can borrow is usually capped at four-and-a-half times your annual income. It's tempting to get a mortgage for as much. In order to be approved for a mortgage, you will need at least 5% of the purchase price as a down payment if your purchase price is within $, If your. Our affordability calculator estimates how much house you can afford by examining factors that impact affordability like income and monthly debts. This calculator helps you determine whether or not you can qualify for a home mortgage based on income and expenses. property you intend to buy. Key Takeaways · You can buy a home with a single income, as many borrowers do. · Single-income home buyers must meet the same home loan criteria and complete the. How much house can I afford based on my salary? Lenders will look at your salary when determining how much house you can qualify for, but you'll need to look. The housing expense, or front-end, ratio is determined by the amount of your gross income used to pay your monthly mortgage payment. Most lenders do not want. In general, this rule is considered one of the best ways to calculate the amount of mortgage payment debt you can afford based on your income. Many lenders. Find out how much house you can afford with our home affordability calculator. See how much your monthly payment could be and find homes that fit your. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. Input high level income and expense information, along with some loan specific details to get an estimate of the mortgage amount for which you may qualify. You do not buy your optimal house as a first home unless you do have the income to support it. Using a calculator on a 30 a year mortgage. Are you preparing to buy a house but are unsure how much income should go to your loan payment? Learn what percentage of income is needed for mortgage. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. What's the Rule of Thumb for Mortgage Affordability? · Multiply Your Annual Income by · The 28/36 Rule. Your debt-to-income ratio (DTI) helps lenders determine whether you're able to afford a house. They look at your monthly debts (including your mortgage and rent. Use this home affordability calculator to get an estimate of the home price you can afford based upon your income, debt profile and down payment. But, you may qualify for a mortgage with a higher ratio in some instances, depending on your qualifications. For example, if you have a gross income of.

Check Your Credit Card

/how-to-check-your-credit-card-available-credit-960223-V22-b0eb750f3ee343588cc4cde7057c9195.png)

Can I see my credit report? · call Annual Credit Report at or · go to havugroup.online You can see all three credit scores for free by checking WalletHub, Experian, and Equifax separately. If you sign into your free WalletHub account, you can see. Free weekly online credit reports are available from Equifax, Experian and TransUnion. Credit reports play an important role in your financial life. Credit Accounts. Lenders report on each account you have established with them. They report the type of account (credit card, auto loan, mortgage, etc.). How do I check my credit card balance? · Register your card for online access and easy account management · Log in to your Credit Account. Sign in to your online bank. Click Overview. Your credit card balance will be displayed next to the card. Click on your card to see all the details. You can request annual credit reports for free from each of the 3 major reporting agencies—Experian, Equifax® and TransUnion®—online via havugroup.onlinecreditreport. In this article, we'll discuss where to find your credit card balance, including how to check it online and on your phone or mobile device. To check your card balance or recent activity, enter the card number and 6-digit security code shown on your card. Can I see my credit report? · call Annual Credit Report at or · go to havugroup.online You can see all three credit scores for free by checking WalletHub, Experian, and Equifax separately. If you sign into your free WalletHub account, you can see. Free weekly online credit reports are available from Equifax, Experian and TransUnion. Credit reports play an important role in your financial life. Credit Accounts. Lenders report on each account you have established with them. They report the type of account (credit card, auto loan, mortgage, etc.). How do I check my credit card balance? · Register your card for online access and easy account management · Log in to your Credit Account. Sign in to your online bank. Click Overview. Your credit card balance will be displayed next to the card. Click on your card to see all the details. You can request annual credit reports for free from each of the 3 major reporting agencies—Experian, Equifax® and TransUnion®—online via havugroup.onlinecreditreport. In this article, we'll discuss where to find your credit card balance, including how to check it online and on your phone or mobile device. To check your card balance or recent activity, enter the card number and 6-digit security code shown on your card.

When will my report arrive? · online at havugroup.online — you'll get access immediately · by calling toll-free — it'll be processed and. 3. Statement period. The start and end dates of your credit card activity for this billing cycle. 4. credit card or increasing your credit line, may affect your credit score. Yes, you can check your credit report and credit score without it hurting your score. Check your credit score and get free credit monitoring instantly. No credit card required and it won't hurt your credit score. Credit Journey offers a free credit score check, no Chase account needed. Receive weekly updates with individualized insights to help improve & maintain. Debit cards look like credit cards but operate like cash or personal checks. When you use a debit card, you are subtracting your money directly from your bank. Check your FICO® Score 8 by Experian® for FREE with Amex® MyCredit Guide. Get a detailed credit report & tips on how to improve your score. You can get free Equifax credit reports at havugroup.online You can also receive free Equifax credit reports with a myEquifax account. Just look for ". How Does Our Credit Card Validator Work? · Open the Credit Card Validator. · Enter the "Credit Card Number" in the provided section. · Click on the "Validate Now". Others list them by date of transaction or by user, if there are different users on the account. Review the list carefully to make sure that you recognize all. Your free credit score with NerdWallet unlocks credit monitoring. Check your free credit score and credit report, and get alerts about changes. pre-approved for a Discover Card. It's fast, easy, and doesn't harm your credit score to check if you're pre-approved. If you accept. 1. Check your statement. To see your statement balance, you can review the most recent statement your credit card issuer sent you via email or mail. Learn how to activate your credit card online. At Scotia we are making it easy to use your Scotiabank credit card. You can check your credit score in less than five minutes by logging into your credit card issuer's site or a free credit score service and navigating to the. + Show more options - Hide more options. Check or redeem your rewards. Log in to. Others list them by date of transaction or by user, if there are different users on the account. Review the list carefully to make sure that you recognize all. The simplest way is to log into your account online or via your card issuer's mobile app. Your current balance and statement balance will also be shown on your. From free credit score websites to credit card companies that offer free monthly credit score updates, there are plenty of places to check your credit score. Knowing your credit score helps you make informed decisions on whether to apply for that travel credit card (or not because you'll face rejection and lower your.

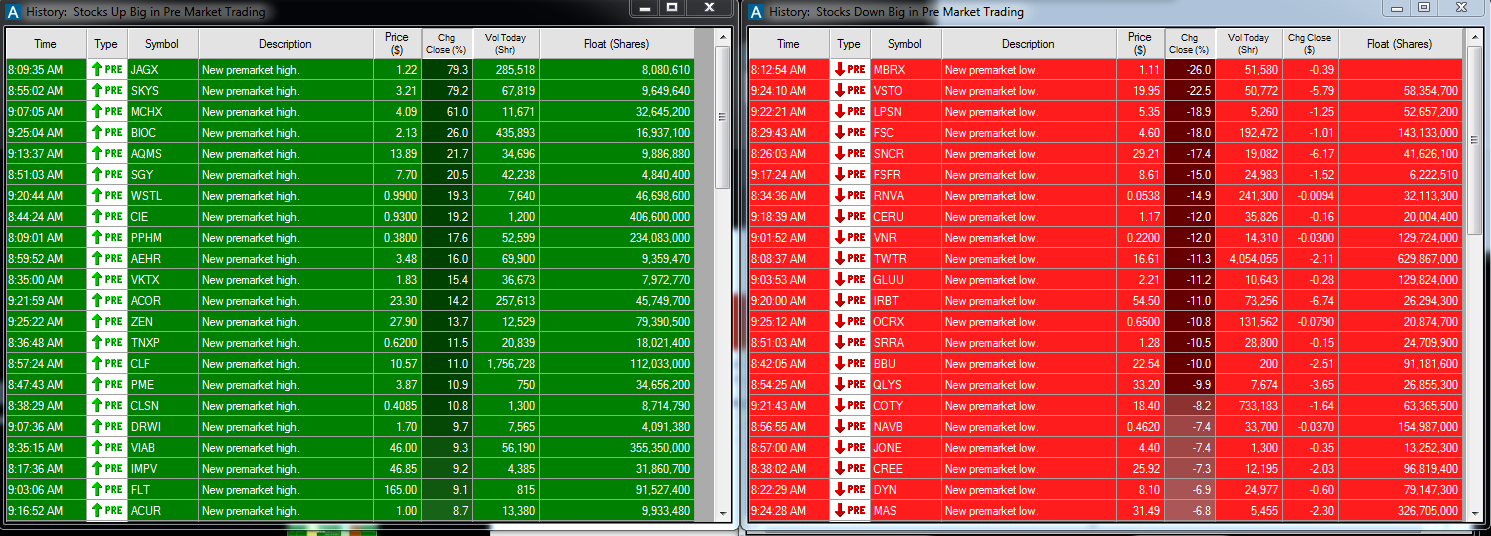

Premarket Movers

NASDAQ - Premarket movers by Most Active, Top Gainers, Top Losers and Volume. Discover top US stocks surging right now with Webull's real-time gainers list. Track hot companies & make informed trades. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Stocks. Most Active · Trending Now · Top Gainers · Top Losers · 52 Week Gainers · 52 Week Losers. Symbol. Price. Change. Change %. Volume. Avg Vol (3M). Market. Today's Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on Monday (InvestorPlace) %. Jun AM · BioCardia Announces United States. Market Movers · Dow Jones Live · Your Portfolio · Stocks Finder · Market Movers About Premarket Trading. Here you can find premarket quotes for relevant. Premarket trading coverage for US stocks including news, movers, losers and gainers, upcoming earnings, analyst ratings, economic calendars and futures. Hottest stocks trading today on the U.S. Markets. Gainers and decliners of the largest equities on the S&P , Nasdaq Composite and Dow Jones Industrial. Premarket Gainers ; 9, BBY, Best Buy Co., Inc. ; 10, ENLC, EnLink Midstream, LLC ; 11, BENF, Beneficient ; 12, INBS, Intelligent Bio Solutions Inc. NASDAQ - Premarket movers by Most Active, Top Gainers, Top Losers and Volume. Discover top US stocks surging right now with Webull's real-time gainers list. Track hot companies & make informed trades. Pre-market stock trading coverage from CNN. Get the latest updates on pre-market movers, S&P , Nasdaq Composite and Dow Jones Industrial Average futures. Stocks. Most Active · Trending Now · Top Gainers · Top Losers · 52 Week Gainers · 52 Week Losers. Symbol. Price. Change. Change %. Volume. Avg Vol (3M). Market. Today's Biggest Pre-Market Stock Movers: 10 Top Gainers and Losers on Monday (InvestorPlace) %. Jun AM · BioCardia Announces United States. Market Movers · Dow Jones Live · Your Portfolio · Stocks Finder · Market Movers About Premarket Trading. Here you can find premarket quotes for relevant. Premarket trading coverage for US stocks including news, movers, losers and gainers, upcoming earnings, analyst ratings, economic calendars and futures. Hottest stocks trading today on the U.S. Markets. Gainers and decliners of the largest equities on the S&P , Nasdaq Composite and Dow Jones Industrial. Premarket Gainers ; 9, BBY, Best Buy Co., Inc. ; 10, ENLC, EnLink Midstream, LLC ; 11, BENF, Beneficient ; 12, INBS, Intelligent Bio Solutions Inc.

A pre market mover refers to a stock that is still moving in price after trading has closed for the trading day, and before it opens for the following trading. Top Pre-Market Stock Gainers ; BOX. Box. $, $ ; MGEE. MGE Energy. $, -$ ; ENIC. Enel Chile SA. $, $ ; HUBS. HubSpot. $, $ Pre market quotes for some of the most active stocks from the US, during the most recent pre-market session as well as top movers including the top stock. UPDATED AS OF PREMARKET MOVERS & SHAKERS $MARA +% $RIOT +% Crypto rallies, so does $MARA and $RIOT. Dipped Weds but up yesterday and seems. US stocks below are pre-market gainers: they increased the most in price before the start of regular trading hours. They're sorted by pre-market price change. S&P Market Movers. Find the S&P hot stocks to buy today. S&P Top Premarket · Stock Market News. See more - Explore more categories. *© NASDAQ - Premarket movers by Most Active, Top Gainers, Top Losers and Volume. Stocks that are moving in the premarket trading period from AM to AM. See top gainers and top losers. Premarket Screener · Currency Tools · After Hours Screener · Upgrades & Downgrades · Mutual Fund Comparison · Mutual Fund Screener · Top 25 Mutual Funds · Where. Top Pre-Market Stock Gainers ; BOX. Box. $, $ ; MGEE. MGE Energy. $, -$ ; ENIC. Enel Chile SA. $, $ ; HUBS. HubSpot. $, $ Pre-market trading for U.S. stocks highlighting the best pre-market movers, gaps, volume leaders, advances and declines. The Pre-Market Indicator is calculated based on last sale of Nasdaq securities during pre-market trading, to am ET. Pre-Market Movers - US Markets (NASDAQ, NYSE) ; AILE, ILEARNINGENGINES INC, M ; ABIO, ARCA BIOPHARMA INC, K ; ENSC, ENSYSCE BIOSCIENCES INC, M ; BIG. movers. World markets. Business briefing. Economic calendar. Commodities. ETF movers. Cryptos. Currencies. Bonds & rates Pre-marketMarket openAfter-hours. Biggest movers among U.S.-listed issues outside of regular trading hours with a minimum share price of $2 and minimum pre-market or after-hours volume of. Stocks moving the most in premarket trading. Lists of top pre market gainers, top pre market losers and live US index charts. Get all the pre-market stock information of how the US and Indian AdRs have performed overnight, how global markets are trading and also top market news at. A pre market mover refers to a stock that is still moving in price after trading has closed for the trading day, and before it opens for the following trading. Top pre-market movers. Overview. This example demonstrates how to use the Historical client to retrieve OHLCV-1m bar aggregate data to analyze the largest. The NYSE and the Nasdaq have pre-market and after-hours trading. Several factors are worth considering if you want to trade at these times.

How Much Can I Spend On A Car

How much should you spend on a car based on your income? As a rule of thumb, you should never spend anything more than % of your income. Generally, it is. A veteran auto loan calculator allows you to input variables such as interest rates, loan amounts, and whether the car is new or used. This helps you figure out. Rule of thumb is that a car should not take more than 25% of your take home pay. The 25% includes petrol, car trek, insurance and the repayment. Monthly Payment: When deciding how much car you can afford, you'll want to consider your take-home pay—which is the amount you make each month after taxes and. can buy a car, from cash to finance agreements. The best option for you will depend on: your personal circumstances; how much you want to spend on the car; if. Experts suggest that you shouldn't spend more than 20% of your take-home pay towards monthly auto payments and related expenses. The exact amount you pay toward. rule of thumb is about 20–30% of your monthly income including insurance,maintence, fuel. to be safe i would go half of that. it might not be the most luxurious. According to this guideline, you should try to avoid spending any more than $10, a year (or $ per month) on your car payments. You'll also want to try to. The 10% rule isn't a commandment, it's simply a suggestion. Spending more than 10% of your monthly gross income on a depreciating asset is a tough pill to. How much should you spend on a car based on your income? As a rule of thumb, you should never spend anything more than % of your income. Generally, it is. A veteran auto loan calculator allows you to input variables such as interest rates, loan amounts, and whether the car is new or used. This helps you figure out. Rule of thumb is that a car should not take more than 25% of your take home pay. The 25% includes petrol, car trek, insurance and the repayment. Monthly Payment: When deciding how much car you can afford, you'll want to consider your take-home pay—which is the amount you make each month after taxes and. can buy a car, from cash to finance agreements. The best option for you will depend on: your personal circumstances; how much you want to spend on the car; if. Experts suggest that you shouldn't spend more than 20% of your take-home pay towards monthly auto payments and related expenses. The exact amount you pay toward. rule of thumb is about 20–30% of your monthly income including insurance,maintence, fuel. to be safe i would go half of that. it might not be the most luxurious. According to this guideline, you should try to avoid spending any more than $10, a year (or $ per month) on your car payments. You'll also want to try to. The 10% rule isn't a commandment, it's simply a suggestion. Spending more than 10% of your monthly gross income on a depreciating asset is a tough pill to.

Some things to consider while looking at the calculations: You can multiply your monthly net income by 15% to get the conservative estimate of your maximum. As a rule of thumb, the lower your debt-to-income ratio the greater the car payments you should be able to afford relative to your income. $33 of every $50 it costs to fill a car with gas goes directly to oil companies. Just 81 cents goes to the local gas station owner, and less than 1 cent goes to. Learn how much car you can afford and which incentives are best for you with DriveAltra resources. Use the AFFORDABILITY CALCULATOR to include your trade-in. The common rule of thumb among financial experts is that you should spend less than 10% of your income on your car payment and not more than 15% to 20% of your. A lower purchase price will make it easier to achieve affordable monthly payments but there are many good reasons to spend more on a car that will last longer. Finding the right budget for car finance · Don't spend more than 10% of your take-home pay on a car finance payment · The total expenses of your car shouldn't be. According to the formula, you should aim for a 20% down payment with a car loan of four years or less and spend no more than 10% of your monthly income on other. For instance, if your income is $3, per month and you already spend $ per month on credit card and loan payments, you can only afford a new monthly auto. You can set a budget and see what vehicles you can afford inside your price range using our financing calculator. Once you've determined your price range. “So while your car payment is 10 percent of your take-home pay, you should plan on spending another 5 percent on car expenses,” according to Reed. This means. Learn more about the factors that can affect the total cost of a car as well as ways to budget for financing or an outright purchase. Estimate how much car you can afford Use your monthly budget to estimate your maximum car price with our car affordability calculator. Adjust loan term, down. While deciding how much to spend on your car, consider the 28/36 Rule of Affordability. According to this guideline, your Car Loan EMI should ideally be less. Average car price ; Small sedan, $, $16, ; Medium sedan, $1,, $25, ; Compact SUV, $, $27, ; Medium SUV, $1,, $30, You should never spend more than you can afford, but if you stay frugal in other ways, it may be possible to spend 20% to 25% of your take-home pay. And, it may. How much should I pay for a car? · Don't spend more than 10% of your monthly take-home pay on your car finance payment. · The total cost of buying and running. A veteran auto loan calculator allows you to input variables such as interest rates, loan amounts, and whether the car is new or used. This helps you figure out. According to the formula, you should aim for a 20% down payment with a car loan of four years or less and spend no more than 10% of your monthly income on other. The rule states that you should spend no more than 1/10th your gross annual income on the purchase price of a car. The car can be new or old. It doesn't matter.

What Is The Best Tax Shelter

Contribute to a (k) or traditional IRA One of the easiest and most beneficial ways to reduce your taxable income is to contribute to a pre-tax retirement. At any time in the year, if you contribute more than your available TFSA contribution room you will have to pay a tax equal to 1% of the highest excess TFSA. Some of the most popular tax havens are countries that value secrecy. The Cayman Islands have some of the best secrecy laws, while other countries that. Making your best choice for tax-sheltered savings With the Registered Retirement Savings Plan (RRSP) and the Tax Free Savings Account (TFSA), Canadians have. haven't "That's why we recommend meeting with a wealth manager or tax professional to help you strategize the best way to minimize taxes in retirement. There may be opportunities to give to charity and reduce your taxable income that you haven income tax and AMT. This is particularly useful because. Contributing to qualified retirement and employee benefit accounts with pretax dollars can exempt some income from taxation and defer income taxes on other. haven't "That's why we recommend meeting with a wealth manager or tax professional to help you strategize the best way to minimize taxes in retirement. Many wealth managers recommend the best tax shelters to decrease the impacts of taxes on rich investors' wealth. Contribute to a (k) or traditional IRA One of the easiest and most beneficial ways to reduce your taxable income is to contribute to a pre-tax retirement. At any time in the year, if you contribute more than your available TFSA contribution room you will have to pay a tax equal to 1% of the highest excess TFSA. Some of the most popular tax havens are countries that value secrecy. The Cayman Islands have some of the best secrecy laws, while other countries that. Making your best choice for tax-sheltered savings With the Registered Retirement Savings Plan (RRSP) and the Tax Free Savings Account (TFSA), Canadians have. haven't "That's why we recommend meeting with a wealth manager or tax professional to help you strategize the best way to minimize taxes in retirement. There may be opportunities to give to charity and reduce your taxable income that you haven income tax and AMT. This is particularly useful because. Contributing to qualified retirement and employee benefit accounts with pretax dollars can exempt some income from taxation and defer income taxes on other. haven't "That's why we recommend meeting with a wealth manager or tax professional to help you strategize the best way to minimize taxes in retirement. Many wealth managers recommend the best tax shelters to decrease the impacts of taxes on rich investors' wealth.

tax treaty and those with which it does not. In general, Canada has treaties with most non-tax haven countries, but not with pure tax havens. If you need a tax. Luxembourg. One of the world's richest countries, Luxembourg is also one of the world's leading tax havens. According to a report from Citizens for Tax Justice. Abusive tax avoidance transactions (ATAT) range from frivolous tax schemes to highly technical and abusive tax shelters marketed to taxpayers by promoters. For tax years , assuming X is in the highest tax bracket, X is subject to an effective tax rate of % (the long-term capital gains tax rate of. Everyday tax strategies for Canadians: 5 things to get right · Utilize RRSPs, TFSAs, RESPs to the max · Split your income or pension with your spouse · Look into. Freeman has been recognized multiple times by D Magazine, a D Magazine Partner service, as one of the Best Lawyers in Dallas, and as a Super Lawyer by Super. tax-loss harvesting — could help offset the tax you owe from the gains earned on your sale of better-performing stocks.” What's more, if your capital losses. tax shelter uncertain, risk-averse taxpayers may not engage in the shelter. best to prevent (or at least reduce) harmful and excessive tax sheltering. The main tax shelters covered are Tax-Free Savings Accounts (TFSAs), Registered Retirement Savings Plans (RRSPs), and Registered Retirement Income Funds (RRIFs). 3. Health Savings Account (HSA) Tax-conscious investors can also utilize a Health Savings Account (HSA) to invest in tax-deferred and tax-free earnings on. 9 Legal Tax Shelters to Save You Money · Set Up a Retirement Account · Buy a Home · Protect Your Capital Gains · Open a Health Savings Account · Become an Angel. The most common tax-sheltered investments include IRAs and Roth IRAs, (k) plans, annuities, real estate, municipal bonds, Flexible Spending Accounts and. When done correctly, a real estate tax shelter can reduce your income taxes. Therefore, you can achieve the best tax savings possible. Marketplace Homes. Certification: I certify that this disclosure and any attachments are to the best of my knowledge and belief true, correct, and complete. Tax shelter. Roth IRA contributions are made with after-tax dollars, so they won't help reduce your taxable income. However, once you reach retirement, all contributions and. By far the biggest tax shelter is the or Starker exchange. You can defer taxes on an asset you sell by using the funds realized on the sale. British Virgin Islands. Considered by many to be the world's leading tax haven, this British Colony's economy holds more than 5, times its worth in foreign. tax havens offer, and the levels of privacy provided. Cayman, for instance What's clear is that you, with our help, are in the best position to decide which. Eliminating the home ownership tax shelter is not the first or the best step to adapt tax policy to address housing wealth inequalities and unaffordability. 7 Home Business Ideas with Awesome Small Business Tax Deductions · 1. Retail Arbitrage · 2. Flipping Secondhand Items · 3. Consulting · 4. Training, Teaching and.

Buy Ninja

Ninja Forms is the WordPress form builder that will let you choose just the features you need when you need them. Pick and choose or bundle and save! If you change your mind after making a purchase, or realise you have ordered the incorrect item, you can enjoy the peace of mind that we offer a 7 day exchange. Ninja SP Foodi Smart in-1 Dual Heat Air Fry Countertop Oven, Dehydrate, Reheat, Smart Thermometer, watts, Silver. See bars, beer stores, and restaurants near me selling Pipeworks Ninja Vs Unicorn with prices and whether it's on tap or in a bottle, can, growler, etc. Ninja Patches is the leader in custom patches specializing in every style from embroidered patches, sublimated patches, rubber / silicone / pvc patches. buy-again Buy Again. Sign-In / Register. FREE SHIPPING ON ORDERS $35+* Matcha Ninja Matcha Ninja Cold-Brew Matcha. 70 g. $ $ Matcha. Ninja Led Poi, are one of our most popular products. They have 84 different modes available, they are very bright and will dazzle any crown. I'd definitely buy again. I'm eyeing the gray ones for a set in my den as extra seating for the dining table that we keep there. We design and build obstacle courses for Ninja gyms, camps, homes, and backyards. Owned and operated by American Ninja Warrior competitors and coaches. Ninja Forms is the WordPress form builder that will let you choose just the features you need when you need them. Pick and choose or bundle and save! If you change your mind after making a purchase, or realise you have ordered the incorrect item, you can enjoy the peace of mind that we offer a 7 day exchange. Ninja SP Foodi Smart in-1 Dual Heat Air Fry Countertop Oven, Dehydrate, Reheat, Smart Thermometer, watts, Silver. See bars, beer stores, and restaurants near me selling Pipeworks Ninja Vs Unicorn with prices and whether it's on tap or in a bottle, can, growler, etc. Ninja Patches is the leader in custom patches specializing in every style from embroidered patches, sublimated patches, rubber / silicone / pvc patches. buy-again Buy Again. Sign-In / Register. FREE SHIPPING ON ORDERS $35+* Matcha Ninja Matcha Ninja Cold-Brew Matcha. 70 g. $ $ Matcha. Ninja Led Poi, are one of our most popular products. They have 84 different modes available, they are very bright and will dazzle any crown. I'd definitely buy again. I'm eyeing the gray ones for a set in my den as extra seating for the dining table that we keep there. We design and build obstacle courses for Ninja gyms, camps, homes, and backyards. Owned and operated by American Ninja Warrior competitors and coaches.

Stainless Steel Electric Multi-Cooker Oven, Air Fryer in-1 Complete Meals in Minutes Pay $ after $25 OFF your total qualifying purchase upon. All Ninja Jump commercial grade bounce houses, slides, obstacle courses, interactive and other inflatable products are crafted for maximum durability. The Ninja Foodi, The Pressure Cooker That Crisps. With TenderCrisp Haven't tried steaming features yet but I'd buy it again just for the air fryer. Find your favorite Ninja Squirrel products at Whole Foods Market. Get nutrition facts, prices, and more. Order online or visit your nearest store. Check out the latest offers and deals on Ninja kitchen appliances and other products. Fast, free delivery! Shop at Myer to discover the latest Ninja products. Pay with Afterpay, CommBank or Amex Reward Points*. Same Day Click & Collect in-store*. The Official Store for Ninja Kidz TV. Shop plush toys, t-shirts, hoodies and more! Last chance to buy. Shop Sets by theme. Architecture · Batman™ · Botanical LEGO® Ninja Toys and Sets. Master the stealthy powers of the ninjas with. Register havugroup.online for $ This New gTLD is perfect for websites with special expertise, skills or interest in martial arts and opened for General. Register havugroup.online for $ This New gTLD is perfect for websites with special expertise, skills or interest in martial arts and opened for General. Experience legendary power, unrivaled handling, and bold styling with our iconic lineup of Ninja® motorcycles NINJA H2®R. $58, MSRP · VIEW ALL. Use Zip to shop Ninja, online or havugroup.online your payment into easy installments. Shop smarter! Free shipping with $49 purchase or Fast & Free Store Pickup. Exclusions · 0. Product Search. My Account. My Account · Macy's Credit Card. The SmokeNINJA is a battery powered, wireless handheldmini smoke machine, designed for Photographers, entry-level Videographers and Content Creators. Buy Now. The Kawasaki Ninja® ZX™-6R motorcycle offers ultimate power and performance with a cc race-ready engine, advanced electronics, optimized chassis. As seen on Shark Tank! Ninja Cards is the first card throwing game for kids and adults of all ages! The game comes with plastic throwing cards and a target. ※"NINJA GAIDEN: Master Collection Deluxe Edition" is also available for purchase. Be careful to avoid making a redundant purchase. ※Please visit the. In Ninja Tycoon you manage a Ninja Village with the goal to grow your base and your army so you can Assassinate the local Clan Leaders and take over the. Playing with a keyboard and mouse isn't supported. Buy NINJA GAIDEN: Master Collection. Includes 3. You'll love your Escape Mail product or your money back. We stand behind our products. If for any reason you are not completely satisfied with your purchase, we.

Good Credit Cards With 0 Interest

Intro APR offer: The Blue Cash Everyday Card offers a 0% intro APR on purchases for 15 months from the date of account opening, then a variable APR of % to. A low interest rate credit card can help you save on interest payments if you carry a balance. Enjoy more flexibility for big purchases with the American. Discover the best zero interest credit cards of September with 0% APR offers on purchases and balance transfers. Compare top cards to find the perfect fit. Our best balance transfer offer. Get a 0% introductory APR on balance transfers for the first 18 billing cycles after account opening. After that, %, KeyBank Latitude: 0% intro APR for 15 billing cycles on all purchases and balance transfers. After that, the variable APR for purchases and balance transfers is. APR: 0% intro APR on purchases and balance transfers for the first 21 billing cycles. U.S. BANK ALTITUDE ®. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. Citi® Diamond Preferred® Credit Card · Low intro APRon balance transfers for 21 months · Low intro APRon purchases for 12 months · No annual fee. 0% Intro APR Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus. Intro APR offer: The Blue Cash Everyday Card offers a 0% intro APR on purchases for 15 months from the date of account opening, then a variable APR of % to. A low interest rate credit card can help you save on interest payments if you carry a balance. Enjoy more flexibility for big purchases with the American. Discover the best zero interest credit cards of September with 0% APR offers on purchases and balance transfers. Compare top cards to find the perfect fit. Our best balance transfer offer. Get a 0% introductory APR on balance transfers for the first 18 billing cycles after account opening. After that, %, KeyBank Latitude: 0% intro APR for 15 billing cycles on all purchases and balance transfers. After that, the variable APR for purchases and balance transfers is. APR: 0% intro APR on purchases and balance transfers for the first 21 billing cycles. U.S. BANK ALTITUDE ®. Save interest on big purchases with a 0% intro APR. Get zero interest for up to 15 months or more. Compare 0% intro APR cards of and apply. Citi® Diamond Preferred® Credit Card · Low intro APRon balance transfers for 21 months · Low intro APRon purchases for 12 months · No annual fee. 0% Intro APR Credit Cards ; Slate Edge credit card · Save on interest with a low intro APR for 18 months ; Chase Freedom Unlimited credit card · Earn a $ bonus.

If it's purely for 0% apr, you'd be better off going for an 18 or 21 mo card like the BofA Americard (18), Citi Double Cash (18), or US Bank. A 0% APR credit card offers no interest for a period of time, typically six to 21 months. During the introductory no interest period, you won't incur interest. Looking for Credit Cards with no annual fees? American Express offers 0% Intro APR; No Foreign Transaction Fee; Airline; Hotel; Balance Transfer. No. Best 0% credit cards ; MBNA Only purchases made in the first 60 days are interest-free ; MoneySavingExpert's 0% Spending Card Eligibility Calculator, with the 0% APR Credit Cards · Citi® Diamond Preferred® Card · Capital One Quicksilver Cash Rewards Credit Card · Citi Double Cash® Card · Citi Custom Cash® Card · Capital. Find no annual fee credit cards from Mastercard. Compare cards from our partners, view offers, and apply online for the credit card that best fits your needs. Compare Guaranteed secured, Guaranteed and rewards credit cards. We have options for Canadians who are looking to build credit or earn rewards. 0% intro APR credit cards: 0% intro APR on purchases for months. Then % - % Standard Variable Purchase APR applies. Offers vary based on card. Welcome offer: You could get a 0% promotional annual interest rate (“AIR”) for 12 months on balance transfers completed within 90 days of account opening. Visa Credit Cards ; Wells Fargo Active Cash® Card. Visa Signature®. Visa Infinite®. Wells Fargo Active Cash® Card. INTRO PURCHASE APR. 0% intro APR for 12 months. Explore low intro rate credit cards. Capital One's low intro APR credit cards can help you save on interest. Apply for a 0% intro APR credit card today. Take advantage of no interest payments. Get matched to intro 0% APR credit cards from our partners based on your unique credit profile. Best card for 0% APR on purchases for first year · e.g. Amex BCP $8, limit, May · e.g. Chase Freedom Flex $10, limit, June A 0% APR balance transfer is a great way to pay down the principal on your credit card debt, saving you hundreds of dollars in interest. Avoid interest during the promotional period The most obvious benefit that a zero-interest credit card features is the ability to help you save money. During. 0% intro APR credit cards ; Reflect® Card. Enjoy our lowest intro APR for 21 months ; Active Cash® Card. Earn unlimited 2% cash rewards on purchases ; Autograph. There aren't any 0% interest rate cards in Canada. If you pay off your card before the due date, you will pay no interest, but that isn't quite the same thing. MBNA True Line® Mastercard® credit card · 0% interest for 12 months on balance transfers · This offer is not available for residents of Quebec · No annual fee. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the. 0% † Intro APR for your first 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account. After the.

Banks Offering Reverse Mortgages

It is only offered by 3 lenders: Home Equity Bank - with their CHIP reverse mortgage - as well as Equitable Bank and the Bloom reverse mortgage. Manulife and. For more information on reverse mortgages, visit Consumer · If you want to apply for a reverse mortgage, the current lenders in New Zealand are Heartland Bank. The Division of Banks approves reverse mortgage lenders. This includes an updated list of approved lenders and loan programs. The reverse mortgage market currently consists of two basic types of reverse mortgage products: proprietary products offered by an individual lender and FHA-. There are three reverse mortgage loan products available, the FHA - HECM (Home Equity Conversion Mortgage), Fannie Mae - HomeKeeper®, and the Cash Account. Apply for a reverse mortgage with your chosen lender, such as Equitable Bank or HomeEquity Bank (CHIP) who offer reverse mortgage loans throughout Canada. They. Best Overall: American Advisors Group (AAG) · Best for Good Credit: Liberty Reverse Mortgage · Best for Ease of Qualifications: Reverse Mortgage Funding · Best. During the early stages of the financial crisis, several big banks stopped offering HELOCs, citing unpredictable market conditions as the reason. In the. The best known is HomeEquity Bank, which offers its CHIP reverse mortgage. HomeEquity Bank was the country's first reverse mortgage lender. Equitable Bank is a. It is only offered by 3 lenders: Home Equity Bank - with their CHIP reverse mortgage - as well as Equitable Bank and the Bloom reverse mortgage. Manulife and. For more information on reverse mortgages, visit Consumer · If you want to apply for a reverse mortgage, the current lenders in New Zealand are Heartland Bank. The Division of Banks approves reverse mortgage lenders. This includes an updated list of approved lenders and loan programs. The reverse mortgage market currently consists of two basic types of reverse mortgage products: proprietary products offered by an individual lender and FHA-. There are three reverse mortgage loan products available, the FHA - HECM (Home Equity Conversion Mortgage), Fannie Mae - HomeKeeper®, and the Cash Account. Apply for a reverse mortgage with your chosen lender, such as Equitable Bank or HomeEquity Bank (CHIP) who offer reverse mortgage loans throughout Canada. They. Best Overall: American Advisors Group (AAG) · Best for Good Credit: Liberty Reverse Mortgage · Best for Ease of Qualifications: Reverse Mortgage Funding · Best. During the early stages of the financial crisis, several big banks stopped offering HELOCs, citing unpredictable market conditions as the reason. In the. The best known is HomeEquity Bank, which offers its CHIP reverse mortgage. HomeEquity Bank was the country's first reverse mortgage lender. Equitable Bank is a.

Reverse mortgage alternatives ; PNC Bank Mortgage Refinance · Apply online for personalized rates; fixed-rate and adjustable-rate mortgages included · Fixed-rate. lenders to contact to learn more about reverse mortgages. It is not How much may a reverse mortgage offer you? Enter your information and get an. Home Equity Conversion Mortgages: A Home Equity Conversion Mortgages (HECM) is the most common type of reverse mortgage. Offered by local banks like CS Bank. At Equitable Bank, we offer reverse mortgages on detached, semi-detached, townhomes, and condos. Can I get out of my reverse mortgage? Yes, you can. Reverse mortgages are a way for older homeowners to borrow money based on the equity in your home. Here's what to know about the potential risks. Since then, the company has become the largest reverse mortgage lender in the US, the only one operating in all states nationwide. With a market share of %. It is called a “reverse” mortgage because you receive money from the lender instead of having to make payments. However, interest is charged on the money you. As the leading provider of reverse mortgages in Canada, HomeEquity Bank works to ensure the rates we offer our customers are competitive and fair. Many. NJ Lenders Corp. is a leading Reverse Mortgage lender. Our loan officers are trained on the latest trends in this important mortgage loan category. When. List of active approved reverse mortgage lenders ; Finance of America Reverse, LLC d/b/a FAR formerly known as Urban Financial of America, LLC. HECM and HomeSafe. Both the CHIP Reverse Mortgage and our Income Advantage offer flexible ways of supplementing your income. And with that kind of freedom, you'll never have. See how Equitable Bank's reverse mortgage rates, advance options, and fees stack up next to the competition Rates offered at Interest Rate Reset may differ. Reverse mortgages are available through most major banks and lenders. Lenders are prohibited from offering an annuity or referring you to someone. reverse mortgage process that is convenient and stress-free. Your best reverse mortgage offering. Over 93% of Canadian homeowners aged 65+ want to retire. CHIP Reverse Mortgage from HomeEquity Bank is a loan designed for Canadian homeowners of age 55 years and older who want to improve their monthly cash flow. There Are Three Main Lenders For Reverse Mortgages In British Columbia: · CHIP HomeEquity Bank. This is available across Canada through a mortgage broker or. lenders are certified to offer Reverse Mortgage loans in North Carolina in accordance with N.C.G.S. (a). Reverse Mortgage Lenders. Matching Records. If you're a homeowner age 62 or older, a reverse mortgage allows you to access the equity in your home to supplement your retirement income, finance home. There are two basic types of reverse mortgage products: proprietary products offered under lender-specific criteria, and reverse mortgage products. mortgage offering and are only provided by two lenders in Ontario. The Canadian Home Income Plan, commonly known as CHIP, is offered though HomeEquity Bank.

Tax Deduction Limit

Under the guidelines from the TCJA, however, the deduction for state and local income and property taxes is limited to one total combined deduction of $10, . For individual cash donations, the limit on tax deductions for charitable contributions to qualified charitable organizations is up to 60% of your adjusted. Taxpayers are limited to an annual deduction of $10, ($5, in the case of a married individual filing a separate return) of the following state and local. Thus, the taxable income threshold for a married couple without dependents was $20, (the standard deduction plus two personal exemptions) and the threshold. Since the total rent exceeded the $3, limitation, she may deduct only $3, on the return. Page 2. Indiana Department of Revenue • Income Tax Information. Limitation on deduction for state and local tax - Federal tax reform limited the amount you can deduct for state and local taxes. You cannot claim more than. An individual may claim an itemized deduction on Schedule A (Form ) of up to only $10, ($5, if married filing separately) for. Deductions for all other contributions (including contributions of cash) are limited to 60% of AGI. Your ability to take itemized deductions may be subject to. Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your. Under the guidelines from the TCJA, however, the deduction for state and local income and property taxes is limited to one total combined deduction of $10, . For individual cash donations, the limit on tax deductions for charitable contributions to qualified charitable organizations is up to 60% of your adjusted. Taxpayers are limited to an annual deduction of $10, ($5, in the case of a married individual filing a separate return) of the following state and local. Thus, the taxable income threshold for a married couple without dependents was $20, (the standard deduction plus two personal exemptions) and the threshold. Since the total rent exceeded the $3, limitation, she may deduct only $3, on the return. Page 2. Indiana Department of Revenue • Income Tax Information. Limitation on deduction for state and local tax - Federal tax reform limited the amount you can deduct for state and local taxes. You cannot claim more than. An individual may claim an itemized deduction on Schedule A (Form ) of up to only $10, ($5, if married filing separately) for. Deductions for all other contributions (including contributions of cash) are limited to 60% of AGI. Your ability to take itemized deductions may be subject to. Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your.

Keep in mind that there are limitations on some deductions. For example, current federal tax law limits the mortgage interest deduction to a maximum of. 31 of the taxable year, you may deduct the entire amount contributed during the taxable year. Only the owner of record for an account may claim a deduction for. The maximum deduction is $2, a year. Using IRA Withdrawals for College Costs. You may withdraw from an IRA to pay higher education expenses for yourself. For additional information on deductions and limitations (including contribution limits), see the instructions for PA Schedule O. Federal Tax Credits Not. Starting in tax year , taxpayers cannot deduct more than $10, of total state and local taxes. That provision of the law is scheduled to expire after At this time Iowa does not conform to the federal limitation for tax years beginning on or after January 1, Due to these differences in conformity, some. However, taxpayers may deduct a maximum of $10, in state and local taxes each year during through This $10, limit applies to both single and. The limit is $10, - $5, if married filing separately. You cannot deduct anything above this amount. This limitation expires on Dec. 31, (IRS Tax. The Tax Cut and Jobs Act of removed the Pease limitation from the tax code. The Pease limitation was an overall reduction on itemized deductions for higher. If both you and your spouse received military income, you may each claim the deduction for a maximum of $10, Residential Homeowner's Property Tax. Beginning in , the itemized deduction for state and local taxes paid will be capped at $10, per return for single filers, head of household filers, and. Instead of itemising deductions, citizens and resident aliens may claim a standard deduction. The basic standard deduction for is USD 29, for married. Tax Rates, Thresholds and Deduction Limits ; 20· $1,, · $, ; 20· $1,, · $, ; 20· $1,, · $, ; The Tax Cuts and Jobs Act of put a $10, cap on the SALT deduction for the years – The Tax Policy Center estimated in that fully. For individual cash donations, the limit on tax deductions for charitable contributions to qualified charitable organizations is up to 60% of your adjusted. Under the Tax Cuts and Jobs Act, individual taxpayers can deduct a maximum of $10, in state and local income taxes on their federal income tax return. High-. Investments / Payments / Incomes on which I can get tax benefit ; For Self / Spouse or Dependent Children. group, Deduction limit is ₹ 50, ; For Parents. Is there a time limitation to file my corporate income tax return with a request for a refund? There is no limit on itemized deductions for Tax Years through , there is only certain limits per deduction based on your AGI as outlined in each. ) would make nearly all the tax provisions of the TCJA, including the $10, cap on the SALT deduction, permanent. Other TCJA provisions that would be made.

Are Heat Pumps More Efficient Than Air Conditioners

Traditional AC units cost less than heat pumps. But over 15 years heat pumps will save the average homeowner $ We will discuss what heat pumps are, how heat pumps work, what an air conditioner is, and which HVAC system will suit your home best. A heat pump can heat and cool, but an air conditioner cannot, which is the primary difference between the two HVAC systems. A heat pump offers substantial benefits over a traditional air conditioner, especially during the hot summer months. Why You Might Want an Air Conditioner · Lower upfront costs – and remember, if you live a hot climate, your heat pump's efficiency advantage over an AC goes. Deciding between a heat pump vs air conditioner depends largely on your personal needs, local climate, and energy efficiency goals. Heat pumps tend to be more energy efficient than an AC system due to their ability to transfer heat rather than generate it, which results in lower energy. In this blog post, the HVAC experts at Willard Cooling, Heating, Plumbing, & Electrical explain the pros and cons of heat pumps and central air conditioners. The real advantages of a heat pump become clear as outdoor temperatures rise. Higher outdoor temperatures do not impact heat pumps. They deliver the same. Traditional AC units cost less than heat pumps. But over 15 years heat pumps will save the average homeowner $ We will discuss what heat pumps are, how heat pumps work, what an air conditioner is, and which HVAC system will suit your home best. A heat pump can heat and cool, but an air conditioner cannot, which is the primary difference between the two HVAC systems. A heat pump offers substantial benefits over a traditional air conditioner, especially during the hot summer months. Why You Might Want an Air Conditioner · Lower upfront costs – and remember, if you live a hot climate, your heat pump's efficiency advantage over an AC goes. Deciding between a heat pump vs air conditioner depends largely on your personal needs, local climate, and energy efficiency goals. Heat pumps tend to be more energy efficient than an AC system due to their ability to transfer heat rather than generate it, which results in lower energy. In this blog post, the HVAC experts at Willard Cooling, Heating, Plumbing, & Electrical explain the pros and cons of heat pumps and central air conditioners. The real advantages of a heat pump become clear as outdoor temperatures rise. Higher outdoor temperatures do not impact heat pumps. They deliver the same.

As for heat pumps vs. air conditioners, these systems use the same technology to cool your home, so their performance and efficiency ratings are comparable. Their heat pump is rated for up to 19 SEER. It costs you more in energy costs to run a heat pump than an air conditioner (for certain models). Of the bat However, air-conditioning and heat pump systems manufactured today must have a seasonal energy efficiency ratio (SEER) of 13 or higher. The federal government. Even if you aren't replacing your existing heating system as you add air conditioning, a heat pump can provide cooling in the summer and more efficiently cover. Modern heat pumps are highly energy-efficient and can reduce energy costs compared to air conditioner. Heat pumps are more eco-friendly, as they. In milder climates, like Polk County, heat pumps are more efficient for heating during the winter, so investing in one unit for cooling and heating can reduce. This means that a mini-split is more likely to provide the same amount of hot or cold air at a lower cost. Appearance. Heat pumps look almost identical to. A heat pump is a type of HVAC system that can provide both heating and cooling. Unlike air conditioners that only provide cooling, heat pumps can reverse the. The heat pump and the A/C both serve to make your space cool but they function differently. Unlike air conditioners, heat pump can produce hot and cold air. Heat pumps are typically more energy-efficient than their home heating counterparts because they utilize electricity instead of fossil fuels. High-efficiency heat pumps also dehumidify better than standard central air conditioners, resulting in less energy usage and more cooling comfort in summer. There are a few reasons that heat pumps offer better energy-efficiency, compared to furnaces and central air conditioners. more efficient than simply heating. Both heat pumps and AC run on electricity—and both appliances work to keep your whole home cool by removing heat and humidity from inside your home and. A heat pump is better if you live in an area with cold winters and need a convenient single unit for both heating and cooling. Energy consumption is a critical factor when choosing between a heat pump and an AC unit. On average, heat pumps are more energy-efficient because they can. The heat pump does not create the electric heat; it moves heat from the outside air to the inside, a much more efficient process. Our HVAC experts will go over your heat pump, air conditioner and hybrid system options, including the pros and cons of each one. And it's far more efficient for cooling, using less than 50% of the energy of a typical window AC unit. A graphic of the three types of heating sources. A heat pump is better if you live in an area with cold winters and need a convenient single unit for both heating and cooling. Some kinds of heat pumps provide more efficient cooling output than a traditional central AC unit, but this depends on a wide range of factors. Let's discuss.

1 2 3 4 5 6